Do you know the ABCs of health insurance? With a good understanding of what some health insurance terms mean, it will be easier to find an insurance plan that meets your needs—and fits within your budget.

Do you know the ABCs of health insurance? With a good understanding of what some health insurance terms mean, it will be easier to find an insurance plan that meets your needs—and fits within your budget.

1) Allowable Costs

Charges for health care services and supplies for which benefits are available under your health insurance plan.

An allowable cost may also be referred to as an allowable charge, an approved charge or an allowed amount. Actual charges are different and refer to the amount billed by the provider for the specific service. The allowed amount is the amount your insurance carrier is willing to pay for the rendered service.

2) Coinsurance

The percentage you pay for the cost of covered health care services, after you meet your deductible.

It’s important to understand that coinsurance and copayments are not the same thing and are two separate parts of your health insurance plan. Read on to learn about copayments.

3) Copayment

A flat fee you pay upfront for doctor visits, prescriptions and other health care services.

Copayments, or copays, do not count toward your deductible. You are typically required to pay your copay when you receive the service. When shopping for plan, look closely to see when you’ll have a copay and how much it will cost for different services.

4) Deductible

The amount you pay out of pocket before your health insurance starts to cover costs.

Tip: Consider keeping your deductible to no more than 5% of your gross annual income.

When shopping for a plan, keep in mind that the deductible is tied to the premium.

| LOW DEDUCTIBLE PLAN = HIGHER PREMIUM |

HIGH DEDUCTIBLE PLAN = LOWER PREMIUM |

5) Flexible Spending Account (FSA)

An account set up through an employer to set aside pre-tax money for common medical costs and dependent care.

An FSA is often part of an employer’s benefits package and allows you to pay for copays, deductibles, medications and other medical expenses with pre-tax dollars. The common rule with funds in an FSA is to “use it or lose it” each year.

6) Health Savings Account (HSA)

A personal savings account that’s used to only cover qualified health care expenses.

An HSA allows you to pay for medical expenses with pre-tax dollars. HSAs are only available to people who have a high-deductible health plan, and any remaining funds may be rolled over year to year.

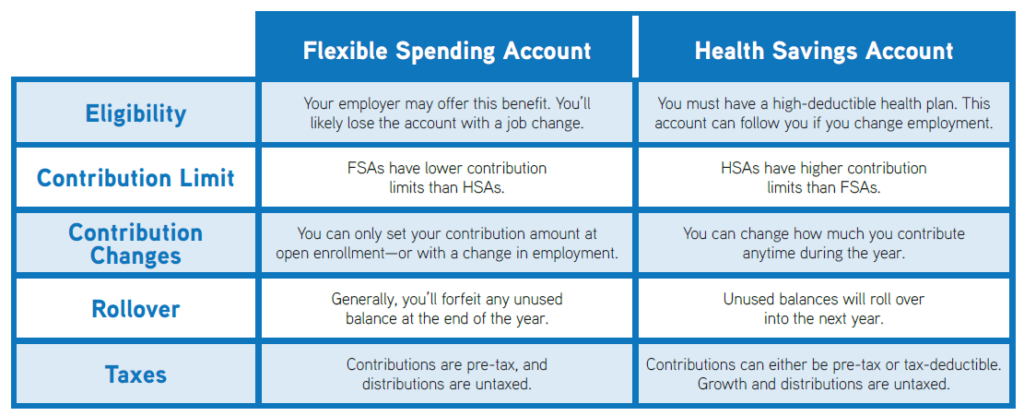

Should you choose an FSA or HSA?

Both accounts have benefits to help you manage out-of-pocket costs throughout the year. There are some differences between the accounts, so refer to this table to find which one is best for you.

7) Network

A group of doctors, labs, hospitals and other health care providers that your plan contracts with at a set payment rate.

Health insurance companies would prefer you to receive services from their in-network providers because it costs them less. If you’re changing plans, do a bit of homework to make sure desired providers are in your network.

8) Out-of-Network Provider

A provider who doesn’t have a contract with your health insurance plan.

You are still able to receive services from out-of-network providers, but it will likely cost you more. Take a look at out-of-network benefits to help make an informed decision about a new plan.

9) Out-of-Pocket Maximum

The highest amount you’ll pay for in-network health care services.

Remember that only covered services from in-network providers will count toward reaching this cap. Once you hit the maximum, you won’t have to worry if you suddenly get seriously sick, become critically injured or need specialized care.

| TOTAL HEALTH INSURANCE OUT-OF-POCKET COSTS |

= | PREMIUM + DEDUCTIBLE + COPAYS & COINSURANCE |

10) Premium

The amount charged by your health insurance company.

Most people pay their premium every month, but payments could be due quarterly or annually. You must pay your premium to keep coverage active, regardless of whether you use it or not. The premium is usually the first cost you see and consider, but it’s important to also factor in details such as copays, deductibles, coinsurance and out-of-pocket maximums.

Contact us today to discuss your health insurance options.